Ever wonder how to get your kids excited about saving money? It can feel like a constant battle between nagging and hoping they’ll magically develop healthy financial habits. But what if there was a secret weapon – a way to shift their thinking and make saving fun and rewarding? Enter the power of a mindset! In this post, we’ll explore how fostering a the right mindset around money can develop responsible money habits in kids.

9 Mindsets That Promote Money Habits in Kids

In addition to a growth mindset, several other mindsets can contribute to building wealth:

1. Abundance Mindset

An abundance mindset involves believing that there are plentiful opportunities and resources available, rather than viewing the world through a lens of scarcity. This mindset encourages children to focus on possibilities, seek out opportunities, and be open to abundance in various forms, including wealth.

2. Long-Term Thinking

Wealth accumulation often requires patience and the ability to think long-term. Children who learn to prioritize long-term thinking over short-term gratification are more likely to make decisions that contribute to their financial success over time.

3. Risk-Taking

While it’s important to be prudent and cautious with financial decisions, taking calculated risks can be necessary for wealth-building. Having a mindset that is comfortable with measured risk-taking can open up opportunities for higher returns and greater financial growth.

4. Financial Literacy

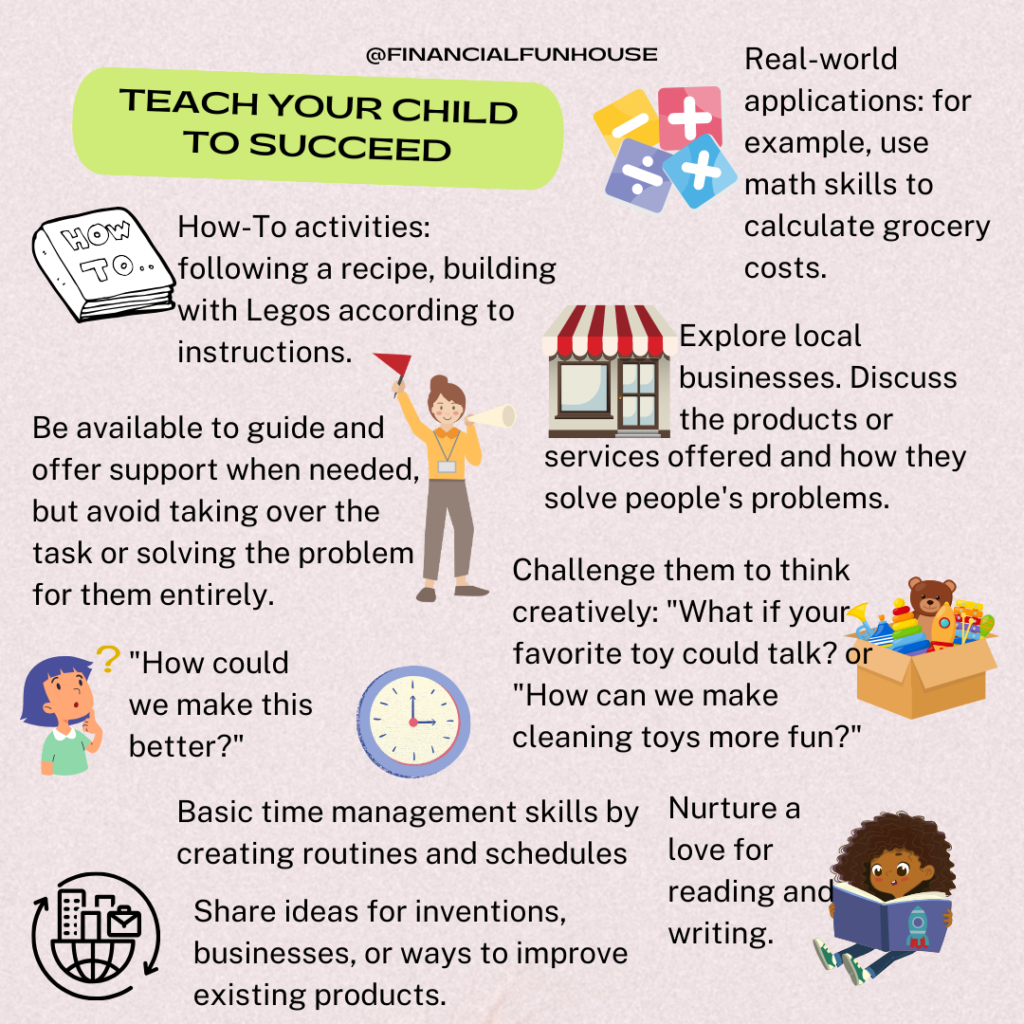

A mindset of continuous learning and curiosity about financial matters is essential for wealth-building. Being financially literate allows individuals to make informed decisions about saving, investing, budgeting, and managing debt, ultimately leading to better financial outcomes.

5. Entrepreneurial Mindset

For those interested in building wealth through entrepreneurship, adopting an entrepreneurial mindset is crucial. This involves being proactive, resourceful, innovative, and willing to take initiative in pursuing business opportunities and creating value.

6. Delayed Gratification

Delayed gratification involves resisting the temptation of immediate rewards in favor of achieving larger, long-term goals. Children who can delay gratification are more likely to make decisions that prioritize long-term wealth accumulation.

7. Gratitude

Appreciating what you already have can lead to making wiser financial decisions and avoiding impulse purchases. It also fosters a sense of contentment that can reduce the pressure to constantly chase more money.

8. Responsibility

Taking ownership of your financial situation is crucial. This means acknowledging your spending habits, learning from past mistakes, and taking action to improve your financial literacy.

9. Action Orientation

A wealth-building mindset isn’t passive. It involves taking initiative, setting clear financial goals, and developing a plan to achieve them. It’s about putting your knowledge and strategies into action.

Put These Mindsets in Action

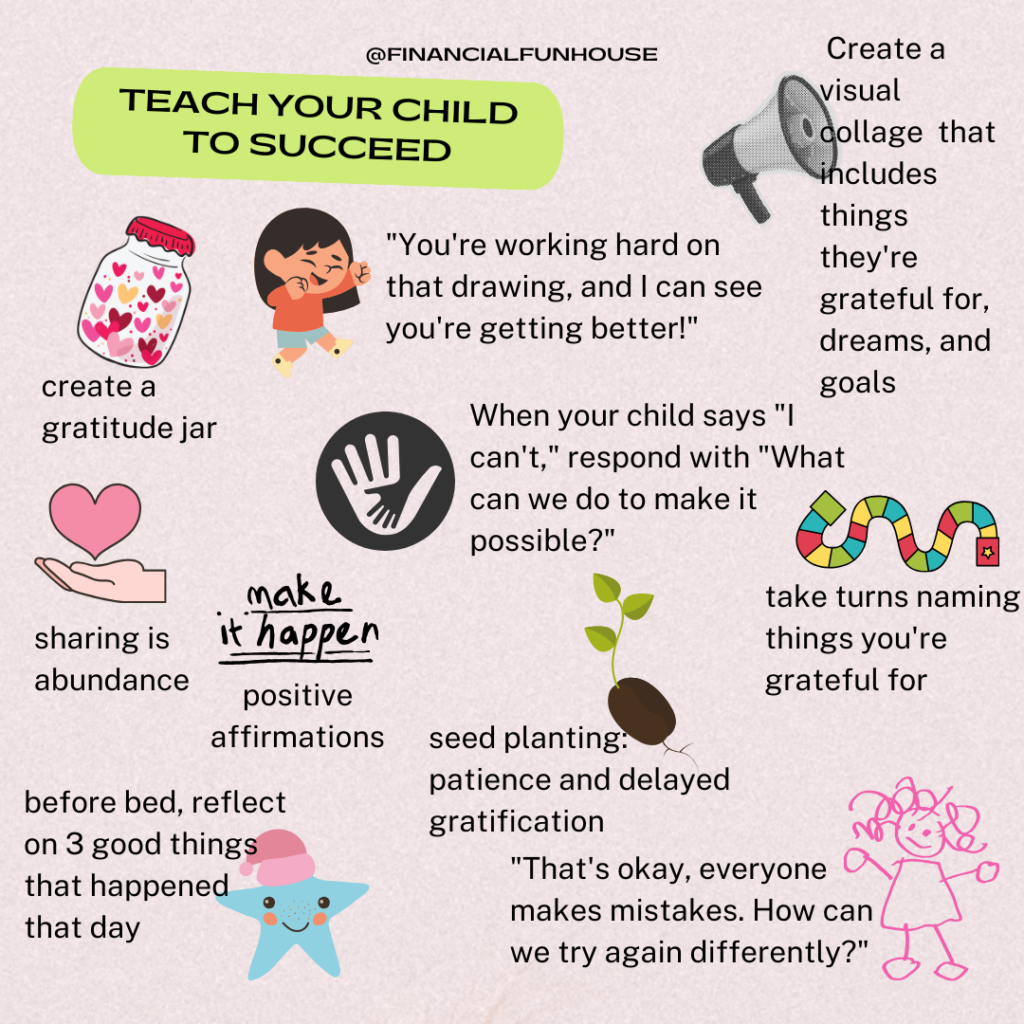

Here are some practical ways to cultivate these mindsets in your child:

Gratitude Jar: Create a jar where your child can write down things they’re grateful for, big or small. Review it together regularly to reinforce appreciation for what they have.

Celebrate mistakes: Help your child see mistakes as learning opportunities. Say things like, “That’s okay, everyone makes mistakes. How can we try again differently?”

“I Am” Statements: Help your child come up with positive affirmations like “I am capable,” “I am kind,” or “I am abundant.”

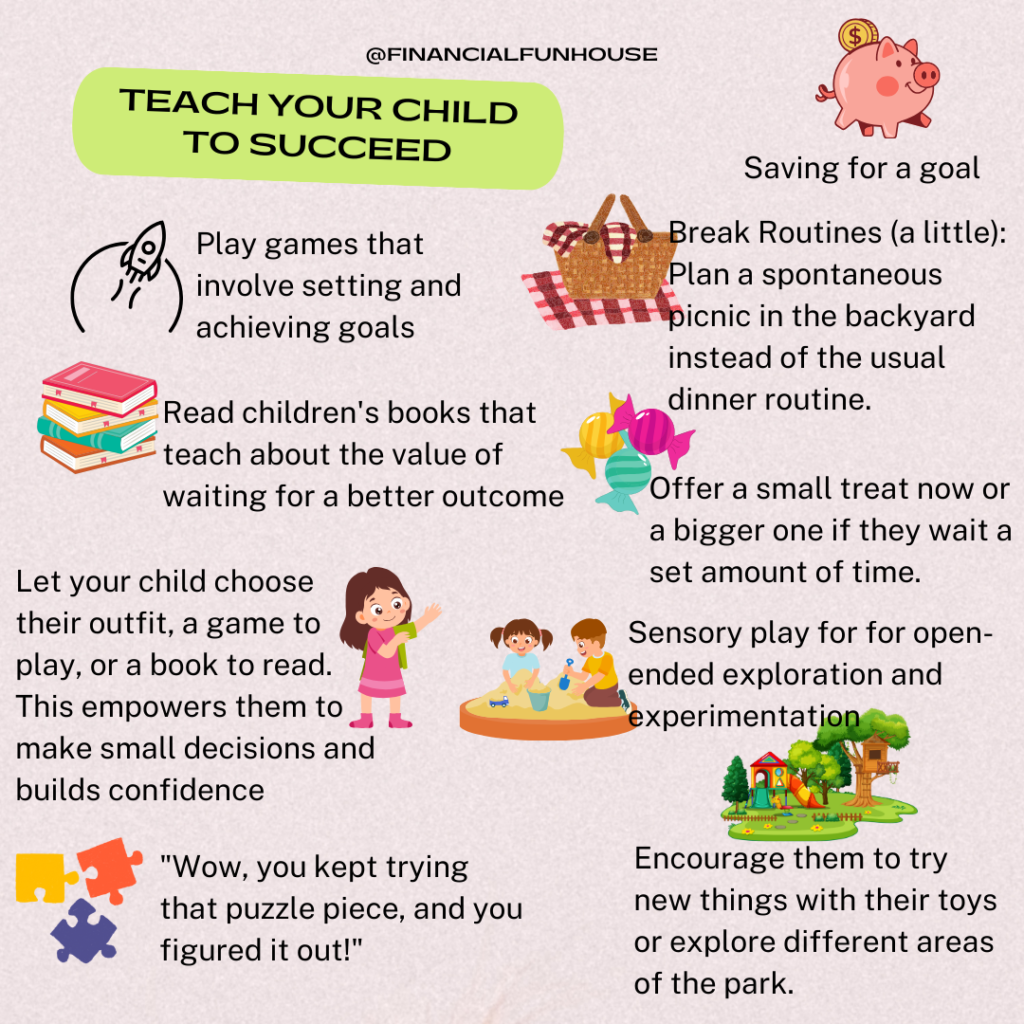

Saving for a Goal: Encourage them to save their allowance for a desired long-term purchase, like a special toy or a trip. Track their progress with a chart.

Break Routines (a little): Plan a spontaneous picnic in the backyard instead of the usual dinner routine. This injects a bit of novelty and encourages them to adapt.

Remember, these mindsets work best in conjunction with each other. By promoting healthy money habits in kids and cultivating a growth mindset alongside these other perspectives. children can develop a well-rounded approach to attracting and building wealth. Encourage financial literacy in your young child with these conversation cards. Spark meaningful discussions and plant the seeds of financial wisdom from an early age!