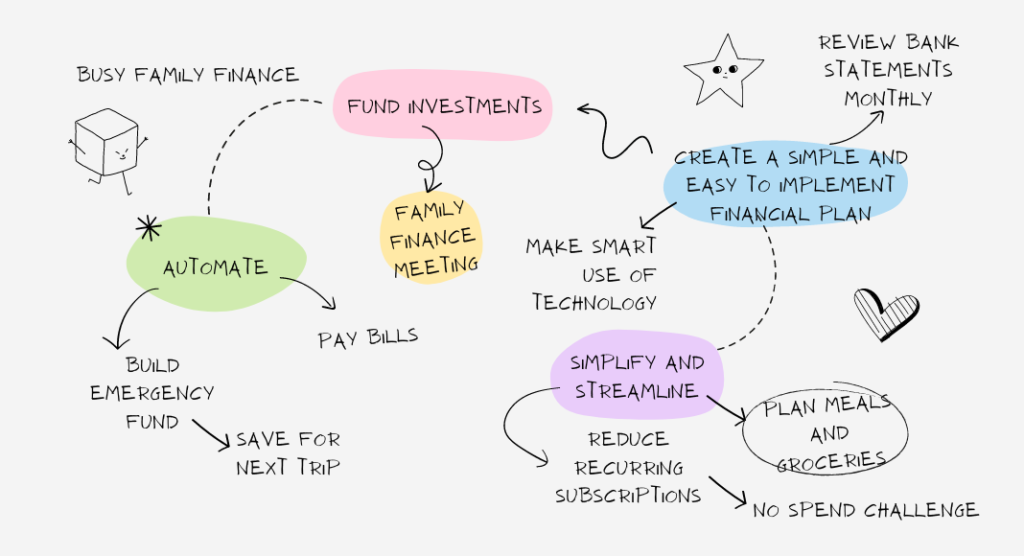

Busy families can absolutely control their finances, even with limited time! Here are some strategies to automate finances that require minimal effort but yield big results:

Automate Finances as a Busy Family:

- Set up automatic transfers: Schedule a portion of your paycheck to automatically transfer to savings or investment accounts. This “pay yourself first” approach ensures you save consistently.

- Automate bill payments: Set up automatic bill payments to avoid late fees and penalties.

- Use budgeting apps: Many budgeting apps connect to your bank accounts and automatically categorize your spending. This provides valuable insights into your spending habits without manual tracking. Or, alternatively, use this affordable budget tracker that helps you trim down on unnecessary spending, guides you to boost savings/investments, and requires only 15 minutes per week.

Simplify and Streamline:

- Reduce recurring subscriptions: Review your monthly subscriptions and eliminate unused services.

- Plan meals and groceries: Plan your meals for the week and create a grocery list to avoid impulse purchases.

- Utilize online bill pay: Pay bills electronically to save time and postage.

- Create a simple and easy to implement financial plan.

Make Smart Use of Technology:

- Set financial goals with apps: Several apps can help you set financial goals and track progress towards them.

- Utilize digital bank statements: Opt for digital bank statements and access them electronically anytime, anywhere.

- Enable budgeting alerts: Some banking apps offer alerts when your account falls below a certain threshold, helping you stay aware of your spending.

Small Shifts, Big Impact:

- Review bank statements monthly: Dedicate 15-20 minutes each month to review your bank statements. Identify areas for improvement and adjust your budget as needed.

- Family finance meeting (once a month): Schedule a quick family meeting (10-15 minutes) once a month to discuss finances with your partner and children. Discuss goals, expenses, and any upcoming needs.

- Embrace the “no-spend” challenge: Challenge yourself to a “no-spend” day or weekend to increase awareness of unnecessary spending.

Remember: Consistency is key! Even small changes implemented consistently can make a significant difference in your busy family’s financial well-being. When you automate finances as a busy family, you reclaim your time and achieve financial peace of mind. By setting up automatic payments, bill reminders, and savings goals that work seamlessly in the background, you will have more time to focus on what matters most – your family.